Judiciary

Federal judge withdraws opinion after lawyer points out fake quotes, misstated case outcomes

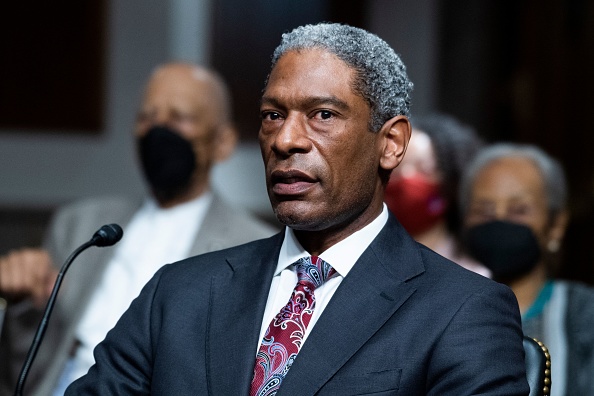

Julien Xavier Neals, then a nominee to be a U.S. district judge for the District of New Jersey, testifies during a Senate Judiciary Committee hearing on pending judicial nominations in Washington, D.C., on April 28, 2021. (Photo by Tom Williams/Pool/AFP via Getty Images)

U.S. District Judge Julien Xavier Neals of the District of New Jersey has withdrawn an opinion after a letter by a BigLaw lawyer pointed out several errors in the decision, including misstated case outcomes and fake quotes attributed to opinions and to the defendants.

Neals withdrew the opinion July 23, saying in a docket entry the opinion and an order had been entered in error.

Bloomberg Law apparently broke the news, while the Volokh Conspiracy has highlights from a July 22 letter detailing the errors.

The letter was written by Andrew Lichtman, a partner at Willkie Farr & Gallagher, who had sought dismissal of a shareholder lawsuit filed against his client CorMedix Inc. The lawyer said the company was not seeking reconsideration of Neals’ denial of the motion, but he did want to point out the problems.

“We wish to bring to the court’s attention a series of errors in the opinion—including three instances in which the outcomes of cases cited in the opinion were misstated (i.e., the motions to dismiss were granted, not denied) and numerous instances in which quotes were mistakenly attributed to decisions that do not contain such quotes,” the letter said.

A representative for Neals’ chamber did not comment when contacted by Bloomberg Law. The ABA Journal placed a call to a number for Neals’ judicial assistant.

“Unfortunately, the court is unable to comment,” the judicial assistant said, without identifying herself.

Bloomberg Law called the case “a rare example of a judge being called out for the sort of elementary mistakes in legal drafting that courts have more frequently pointed out in the work of lawyers. Such flaws have come to the fore as lawyers increasingly rely on artificial intelligence to assist in case preparation, though there is no mention of AI in the complaints the attorneys have directed at Judge Neals.”

Bruce Green, a legal ethics professor at the Fordham Law School, told Bloomberg Law that judges can face sanctions for the same kind of errors that lawyers make in their work. He pointed to ethics rules stating that judges shall perform judicial and administrative duties competently and diligently.

Neals, an appointee of former President Joe Biden, misstated opinion outcomes, as well as holdings about how plaintiffs can show knowledge of misstatements by companies, according to allegations in the letter. The plaintiffs suing CorMedix claim that the company lied about one of its drugs.

These are the three cases with misstated outcomes and holdings, according to the letter:

• Dang v. Amarin Corp., a 2024 decision in the District of New Jersey. Neals said the opinion applied the “core operations doctrine,” which asks courts to assume corporate knowledge of issues involving core products. But the decision actually dismissed a securities fraud complaint and rejected plaintiffs’ arguments under the doctrine.

• In re Intelligroup Securities Litigation, a 2007 decision in the District of New Jersey. Neals said the opinion held that executives made actionable misstatements by signing certifications under the Sarbanes-Oxley Act despite knowledge of serious internal control failures. In reality, the opinion dismissed a securities suit and said it did not infer defendant knowledge from the certifications.

• Stichting Pensioenfonds Metaal en Techniek v. Verizon Communications. Neals’ opinion said the decision was issued in 2021 in the Southern District of New York, but he may have been instead referring to an opinion issued in 2025 in the District of New Jersey. Neals said the Stichting decision found that access to internal emails and memos supported a “finding of scienter.” But the opinion actually granted a motion to dismiss and rejected plaintiffs’ arguments in support of scienter. Nor did the opinion discuss internal emails or memos.

Neals’ opinion also attributes these quotes to cases that don’t contain them, the letter alleges:

• “The absence of insider trading is not dispositive.”

• “The importance of the product to the company’s financial success supports the inference of scienter.”

• “The lack of any competing inference that is more plausible than plaintiffs’ suggested inference … reinforces a strong inference of scienter.”

• A reference to “classic evidence of scienter.”

• False certifications to the government became “false statements in their own right.”

These quotes were attributed to defendants, even though there is no allegation that they made them, according to the letter:

• CorMedix has “resolved all issues related to manufacturing,” attributed to the CEO.

• CorMedix issued statements that the company had “all necessary controls and processes in place for approval.”

Neals’ opinion was cited as supplemental authority in another securities class action suit alleging that a biopharma company lied about a product. Lawyers for the plaintiffs told Bloomberg Law that they would withdraw the supplemental notice after lawyers for Cooley pointed out some of the errors.

Write a letter to the editor, share a story tip or update, or report an error.